The continual growth in the meat alternatives market may seem like a threat to the meat industry. However, an overwhelming majority of the population still considers themselves “meat-eaters.” Flexitarians, pescatarians, vegans, and vegetarians only make up about 29% of the consumer population, meaning nearly three out of every four consumers still want meat in their diets.

The continual growth in the meat alternatives market may seem like a threat to the meat industry. However, an overwhelming majority of the population still considers themselves “meat-eaters.” Flexitarians, pescatarians, vegans, and vegetarians only make up about 29% of the consumer population, meaning nearly three out of every four consumers still want meat in their diets.

Despite millions being spent on marketing meatless burgers and meat alternatives, the majority of consumers are buying and consuming conventional meat as regular parts of their diets. Many popular diet trends like Keto and intuitive eating support these claims.

There are many factors that influence consumers who opt for the real thing. Combined, they present a compelling case for meat vs. meat alternatives. What are those factors and how can the food industry maximize its market share?

What’s Driving the Meat-Eating Trend?

Price. Recent studies show that with the influence of price, as many as 72% of consumers chose farm-raised beef as opposed to plant-based and lab-grown meats. That number increased to 80% when name brands were added to the products. Farm-raised beef maintains the majority market share even when plant-based and lab-grown alternatives are offered at lower prices.

Consumers are concerned with the price of meat alternatives and, once they try them, they don’t necessarily make repeat purchases. That could explain why, after significant growth in preceding years, the meat alternative market stalled in 2021.

Recent consumer studies show that meat-eaters are willing to pay more for higher quality meat. However, they are not willing to pay more for meat alternatives. In one university study, a more attractive price point for traditional meat was statistically significant in drawing participants away from meat alternatives.

Nutrition. Consumers, especially older generations, are pushing for healthier lifestyles. The problem is that these consumers still want to eat meat and benefit from its lower price point, but they want the increased health benefits that are claimed by meat alternative producers.

Clean labels. One factor that draws many consumers away from meat alternatives is the number of ingredients listed on their labels. Not only are there too many ingredients, but many consumers also say that they sound “too much like a chemical.” In contrast, traditional meat products, like a traditional burger, have far fewer ingredients, oftentimes only having one.

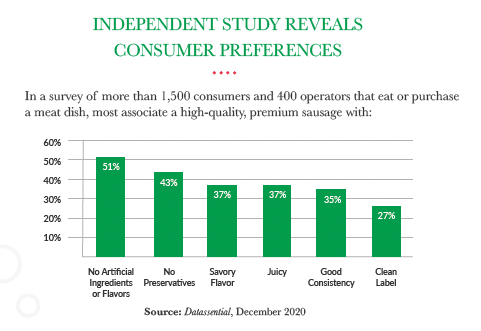

Consumers are looking for products that lack additives and preservatives and they are willing to pay more for higher-quality meat products. The graph above shows recent Datassential survey results regarding the top claims consumers search for on their labels, whether it is conventional meat or a meat alternative. However, as noted earlier, consumers are more likely to choose conventional meat, especially when both products display similar label claims.

Consumer perception. Why do consumers prefer a juicy burger made from real meat vs. meat alternatives? Part of this is due to the fact that meat, such as ground beef, is seen as comfort food. During the pandemic, people were shopping for comfort foods more than ever. This resulted in a large boom in meat sales, specifically ground beef. The surge in demand even led to some meat shortages across the country.

Increased Yields Help Increase Profits

It’s clear that meat alternatives will have a significant uphill battle to unseat the conventional meat product market. That’s despite meat markets having experienced significant price volatility in recent months. Any opportunity a producer has to extend yield in ground or processed meat products without negatively impacting flavor or texture is a welcome sight.

Grande Festo™ is a new, all-natural hydrolyzed whey protein product that provides a cost-saving, yield-improving solution for meat producers. This innovative, clean-label ingredient is recognized and accepted by consumers, and they’ll appreciate how it improves texture and mouthfeel without producing off-flavors.

When compared to a starch control in a sensory panel study, Grande Festo outperformed across all categories including umami flavor, meaty flavor, tender texture, glossy/juicy appearance and salty perception. Aside from the enhanced taste, texture and mouthfeel, additional benefits of Grande Festo are that it:

- Does not fall under the category of fillers and binders for meat ingredients

- Minimizes storage and handling requirements

- Improves profits with higher yields and is a price-stable ingredient

- Can be used in existing food production systems with ease

- Is freeze/thaw stable

- Is SQF, Grade A, USDA, Kosher, Halal and EU Certified

Discover how Grande Festo can address the many challenges of conventional meat production and outperform meat alternatives, plus see how it can be incorporated into several ground meat formulations. Learn data including its wholesale costs and savings in R&D time.

Contact the food formulation experts at Grande Custom Ingredients to request a sample of Grande Festo and talk through your formulation challenges. Also check out the Guide to Better Meat Applications below showing how to improve quality and increase yield.